OnPoint Subscriber Exclusive

Teresa Ghilarducci

Says More…

This week, PS talks with Teresa Ghilarducci, Professor of Economics at The New School for Social Research.

Project Syndicate: Before last year’s midterm elections in the United States, you warned that if Americans elect Republicans “out of anger over inflation, they will not get lower inflation. Instead, they will see benefits, programs, and rights valued by the majority of Americans systematically gutted.” Which benefits, programs, and rights are on the GOP’s chopping block, and what can President Joe Biden’s administration do now to safeguard them?

Teresa Ghilarducci: Well, you got it. During the debt-ceiling negotiations in June, Republicans maneuvered to implement stricter work requirements for people aged 50-55 eligible for the Supplemental Nutrition Assistance Program (SNAP), which augments the grocery budgets of low-income Americans. They argue that stricter requirements are needed to ensure that the program does not discourage employable people from working. But research shows that most SNAP recipients are already working or providing unpaid care to family members, and that work requirements do not increase labor-force participation. Instead, they discourage people from applying for benefits.

In other words, the change to SNAP requirements is not about getting more people into the workforce at all. Rather, it is a display of hostility toward Americans in need. To protect as many people as possible, the Biden administration must get everyone who is eligible for SNAP signed up by streamlining and automating the process.

Republicans have also pushed for the formation of a commission to “review” Social Security and Medicare, with the implicit goal of cutting benefits. The last Social Security deal, reached in 1983, was a “grand bargain,” in which everyone supposedly gave a little. Benefits were cut (by raising the retirement age) and revenues were raised (by hiking payroll taxes). The promising new 401(k) system, together with an increase in quality work opportunities for older Americans, was supposed to make up for the benefit cuts, and rising wages were expected to bring in more revenue. But that never came to pass.

That does not matter to Republicans, who have spent the last 50 years pushing for more Social Security cuts. Today, it is America’s impending insolvency that supposedly makes cuts necessary. This raised the risk of a new “grand bargain,” which would cut benefits further. (In 2016-17, I regrettably signed a Bipartisan Policy Center Commission Grand Bargain.)

Fortunately, such a bargain is now off the table. But it is estimated that Social Security will have enough money to pay only about 77% of total scheduled benefits in 2033, which would hurt those who rely on Social Security the most. That is why Democratic Party leaders – including Biden and Secretary of Transportation Pete Buttigieg – as well as US Senator Bernie Sanders, are advocating an expansion of Social Security, backed by adequate funding.

I don’t see any support for another Social Security Commission. Everyone knows the numbers. Restoring the system’s solvency isn’t that complicated.

Go beyond the headlines with PS - and save 30%

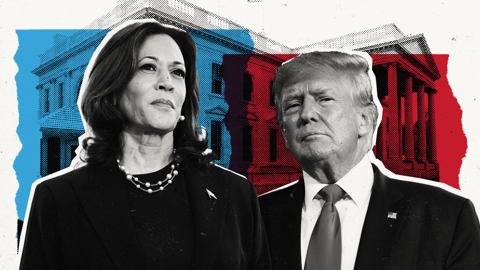

As the US presidential election nears, stay informed with Project Syndicate - your go-to source of expert insight and in-depth analysis of the issues, forces, and trends shaping the vote. Subscribe now and save 30% on a new Digital subscription.

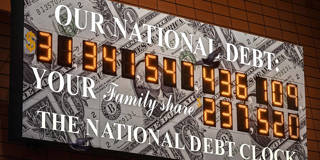

PS: You also worried, correctly, that if Republicans gained control of one or both houses of Congress, they would politicize the US debt ceiling and threaten outright default, raising the “risk that ratings agencies will downgrade US bonds – a move that would cause worldwide havoc.” Fitch recently did just that, citing a “steady deterioration in standards of governance,” “repeated debt limit standoffs and last-minute resolutions,” and the lack of a “medium-term fiscal framework.” But so far, no havoc. What might the medium- and long-term consequences be?

TG: No havoc yet, because Congress settled the debt limit. But dark clouds remain.

Most experts thought that Fitch’s downgrade of America’s long-term credit rating was strange. The decision came many months after the debt-ceiling politics were resolved, and the US economy had had several good reports. That is why Treasury Secretary Janet Yellen called the downgrade “arbitrary” and “based on outdated data” – an assessment with which many agreed.

Nonetheless, ratings agencies like Fitch are not unreasonable in viewing Republican intransigence on the issue of raising revenues as cause for concern. Simply rolling back the tax cuts implemented by Donald Trump would go a long way toward restoring fiscal balance, with little loss. Even conservative and neutral agencies agree the Trump-era tax cuts have done little for economic growth, while worsening wealth and income inequality.

The downgrade should thus be viewed as a warning: politicizing government finances carries real risks, and a US default is not impossible.

PS: In 2021, you expressed hope that the “strong public support for workers” elicited by the COVID-19 pandemic would be translated into “concrete policies that strengthen labor rather than capital,” following a “long-term decline in labor’s share of total national income.” To what extent has “worker power” strengthened since then?

TG: Efforts by the Biden administration and the US Congress to stimulate private investment in key industries creates demand for trainable labor in the parts of the country that were left behind by the economy’s globalization-fueled transformation. Renewed public and private investment, together with the post-pandemic surge of consumer spending, have created a high-pressure economy, characterized by relatively strong economic growth and low unemployment. This has been good for labor.

Wages have grown so much at the bottom that wage inequality is starting to moderate. Even with high inflation – a problem all over the world, owing to supply-chain issues and the Ukraine war – the lowest-wage workers in leisure and hospitality saw their hourly wages increase by 0.3% between the first quarter of Biden’s presidency and July 2023. Meanwhile, the real wages of the highest-paid workers have fallen – by 9.2% in financial services, for example.

In fact, the Biden administration may turn out to be among the most worker-friendly US administrations in a century. The kinds of large federal construction projects it is spearheading must meet higher labor standards, including providing much higher wages. The administration has also sought to increase salary thresholds for overtime pay (thereby ensuring that low-wage workers are not simply labeled managers to avoid paying it); make it harder for companies to classify workers as independent contractors; and improve workplace health and safety standards.

Yes, the labor share of national income has fallen, as it does in all recoveries. But it has not reached the lows we saw in 2015.

BY THE WAY . . .

PS: You and Drystan Phillips recently published research that challenged the widespread assumption that Americans claim their retirement benefits only when they retire. What were your key findings, and what does this mean for the question of whether to raise the US retirement age?

TG: This is one of the most powerful set of numbers I have published in 40 years. Social Security reformers have devised incentives for workers to delay retirement by giving enormous benefits to those who start claiming at later ages, all the way to age 70. Indeed, monthly benefits are 35% higher at 70 than 62.

Yet one out of five older workers still start claiming Social Security benefits at age 62, as soon as they are eligible. And these are most likely to be low-income workers, who are more than three times as likely as high-income workers to claim early. Many of these workers are still in the workforce; they need the Social Security check to supplement their incomes. Meanwhile, high earners can afford to wait to claim at 70 and enjoy the increased benefits.

Literally everyone involved in the 1983 decision to cut Social Security benefits by raising the retirement age claimed that the move would do no harm. Computers were making jobs easier; age-discrimination laws were getting tougher; mandatory retirement had been outlawed; and new kinds of pensions, like 401(k) plans, meant that workers would reap significant benefits from working longer. In fact, cutting Social Security benefits did not improve jobs, stem the rise in inequality of life expectancy, or expand access to 401(k) plans. What it did do is give low-paying employers a larger supply of older workers willing to work for less.

PS: The retirement system needs to be reformed, you argue. The current system, a “patchwork of do-it-yourself programs and narrowly targeted policies,” has contributed to a “retirement savings crisis that demands congressional action.” What kind of action is most urgent?

TG: The risk of poverty for elderly people – and the total number of elderly people in poverty – is increasing. The middle class did not get the pensions they expected, the 401(k) system has failed, and most people approaching retirement have little beyond Social Security on which to rely. But Social Security benefits are too low, amounting to about $1,800 per month. And continuing to work is often not an option: only half of workers over 51 have continuous work.

Biden should make the retirement crisis a top priority in his coming presidential campaign. More Social Security revenue, higher benefits, and universal pensions are essential.

PS: Any such reform, you explain, must recognize that the Social Security program “serves as the bedrock of the US retirement system.” What more can be done to ensure Social Security’s solvency, so that it meets the “future retirement needs of people working today”?

TG: Lift the cap. The maximum amount of income that is subject to the Social Security tax is $160,200 per year. Only 6% of people earn more.

The biggest reason the 1983 Social Security reforms did not have the desired effect is that inequality of earnings is massive. Higher-income people have enjoyed much faster increases in their salaries and bonuses than their lower-income counterparts, and most of those increased earnings were over the cap, so they avoided Social Security taxes. Simply by lifting the cap on Social Security, as we did on Medicare, the US could stabilize the system and reduce the poverty rate among the elderly. I used to worry that if the rich had to pay more toward Social Security, without receiving more benefits, there would be a major backlash. But that did not happen when the Medicare tax cap was lifted.